How stablecoins and programmable money are solving the $316 billion cross-border payments challenge

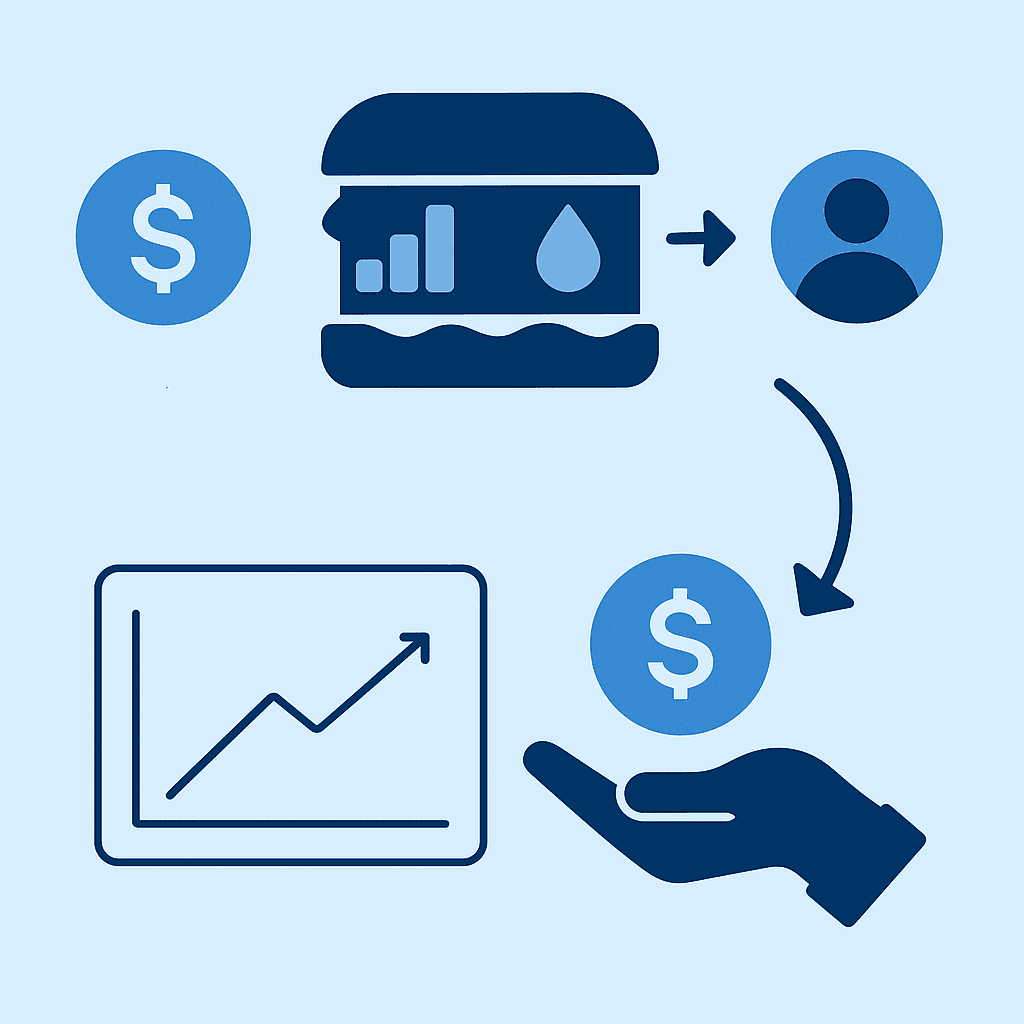

The global cross-border payments market, valued at $212.55 billion in 2024 and projected to reach $316.78 billion by 2030, faces a fundamental architectural problem that has persisted for decades. Businesses sending money internationally must choose between speed, cost, and programmability—but traditional payment rails make it impossible to optimize for all three simultaneously.This isn't just a technology limitation. It's a cross-border payment trilemma that costs businesses billions in fees, delays, and manual processes every year. Until now.

Understanding the Cross-Border Payment Trilemma

The Three Critical Attributes

Every cross-border payment system must balance three fundamental requirements:1. Speed - How quickly funds move from sender to recipient 2. Cost - Total transaction fees, FX spreads, and hidden charges 3. Programmability - Ability to embed business logic, conditions, and automationTraditional financial infrastructure forces businesses to prioritize only two of these three attributes:

Speed + Cost = No Programmability

Wire transfers offer fast settlement (1-3 days) at premium pricing

Fees averaging

6.25% for $200 transfers

according to World Bank data

Zero automation or conditional logic capabilities

Manual reconciliation and compliance checking required

Cost + Programmability = No Speed

ACH batch processing reduces fees but extends settlement

3-7 business day processing windows

Some workflow automation possible but limited

Business-hours-only operation constraints

Speed + Programmability = High Cost

Premium SWIFT services with enhanced messaging

Expedited processing fees and priority routing charges

Advanced features available but at significant cost premium

Limited to bank operating hours and correspondent networks

Why Traditional Payment Rails Can't Solve All Three

Correspondent Banking's Structural Limitations

The correspondent banking system underpinning most international transfers was designed in the 1970s. Cross-border payments are usually characterised by slow processing times and lack of transparency around transaction flow and pricing, according to industry research.Multiple Intermediary Problem:

Each bank in the payment chain adds processing time and fees

Average of 2-4 intermediary banks per international transfer

Compliance checks at multiple points create delays

Settlement requires pre-funded nostro/vostro accounts globally

Legacy Infrastructure Constraints:

SWIFT messaging designed for human processing and batch operations

Mainframe-era systems with limited automation capabilities

Siloed compliance and risk management systems

No native support for conditional payment logic or smart contracts

The Economics of Traditional Cross-Border Payments

Traditional payment providers face fundamental economic constraints that prevent trilemma optimization:Capital Inefficiency:

Banks must maintain costly correspondent relationships worldwide

Billions in liquidity tied up in pre-funded accounts

Manual processes require significant operational overhead

Compliance costs distributed across limited transaction volume

Fee Structure Dependencies:

Revenue models based on transaction fees and FX spreads

High fixed costs necessitate premium pricing for faster services

Limited ability to offer programmable features without custom development

Economies of scale favor large financial institutions over innovation

The Hidden Costs of the Trilemma

Quantifying Business Impact

The cross-border payment trilemma creates measurable costs beyond transaction fees:

Working Capital Impact:

3-7 day settlement period tie up business capital

Foreign exchange exposure during extended settlement windows

Delayed access to funds impacts cash flow management

Opportunity costs from idle capital during transit

Operational Efficiency Losses:

Manual reconciliation processes consuming finance team resources

Separate systems required for compliance and payment tracking

Error rates from manual data entry and processing

Limited visibility into payment status and settlement timing

Competitive Disadvantages:

Inability to offer instant settlement to international suppliers

Higher operational costs passed through to customers

Limited ability to automate international business processes

Reduced agility in global market opportunities

Industry-Specific Pain Points

Manufacturing and Supply Chain:

Just-in-time inventory requires predictable payment settlement

Multi-party transactions need conditional release mechanisms

Currency hedging complicated by settlement delays

Documentary credit processes remain manual and time-intensive

Digital Services and SaaS:

Subscription billing across borders requires automation

Instant customer refunds impossible with traditional rails

Revenue recognition delayed by settlement uncertainty

Global contractor payments create significant administrative overhead

E-commerce and Marketplaces:

Seller payouts delayed by international settlement windows

Customer payment disputes complicated by cross-border processes

Dynamic pricing difficult without real-time settlement

Split payments to multiple parties require manual coordination

How Stablecoins Break the Cross-Border Payment Trilemma

The Programmable Money Revolution

Stablecoins represent a fundamental architectural shift from "moving money" to "programming money." Blockchain and stablecoins represent the biggest infrastructure upgrade to payments in decades because they're programmable, global, and instant.n

Speed Without Compromise:

Settlement in seconds to minutes

24/7/365 operation

No correspondent banking delays or intermediary approvals

Instant confirmation and transaction finality

Real-time tracking and transparency across entire payment lifecycle

Cost Efficiency at Scale:

Transaction fees under $0.01

on efficient blockchain networks

No intermediary bank charges or correspondent fees

Transparent, market-driven foreign exchange rates

Elimination of nostro/vostro funding requirements

Native Programmability:

Smart contract-based conditional payment logic

Automated compliance checking and regulatory reporting

Dynamic payment terms, escrow, and multi-party settlements

Composable financial workflows integrated with business systems

Technical Architecture Advantages

Atomic Settlement:

Payment and settlement occur in single blockchain transaction

Eliminates settlement risk and counterparty exposure

Programmable conditions executed automatically on-chain

Immutable transaction records for audit and compliance

Network Effects:

Shared infrastructure reduces individual institution costs

Open protocols enable rapid innovation and feature development

Interoperability between different stablecoin networks

Global liquidity pools improve exchange rates and availability

Regulatory Compliance:

Built-in AML/KYC checking through on-chain identity systems

Automated sanctions screening and compliance reporting

Transparent transaction flows for regulatory oversight

Programmable compliance rules enforced at protocol level

Real-World Impact: Market Data and Growth

Stablecoin Cross-Border Payment Adoption

The transformation from theoretical to practical is happening at unprecedented scale:Market Growth Statistics:

Stablecoin supply increased from

$5 billion to $220+ billion

in five years

$32 trillion in stablecoin transaction volume

in 2024 alone

$6 trillion in payments-focused stablecoin usage

, representing 3% of global cross-border volume

Projected growth to

20% of cross-border payments

by 2029

Transaction Performance:

Settlement times under 60 seconds

vs. 3-7 days traditional

Transaction fees below 0.1%

vs. 6.25% average traditional cost

24/7 operation

vs. business-hours-only traditional systems

100% transparency

vs. limited visibility in correspondent banking

Industry Implementation Examples

Payment Service Provider Success:

BVNK processes

$12 billion annually

in stablecoin payments

Deel uses stablecoins for global contractor payments

Circle's Payment Network connecting financial institutions globally

Stripe's Bridge enabling stablecoin integration for merchants

Geographic Market Penetration:

Nigeria, Kenya, and Ghana

seeing rapid stablecoin adoption for cross-border trade

Latin America

corridors reducing remittance costs from 10%+ to under 2%

Asia-Pacific

B2B payments transitioning to blockchain rails

European

financial institutions piloting stablecoin settlement systems

Competitive Landscape Evolution

Major payment companies are rapidly integrating stablecoin capabilities:Traditional Players Adapting:

Visa settled cumulative

$200 million in stablecoin payments

Mastercard enabling stablecoin settlement for cross-border transactions

PayPal offering stablecoin-based international transfer services

SWIFT exploring integration with stablecoin networks

Fintech Innovation Leaders:

Stripe's acquisition of Bridge for stablecoin orchestration

Worldpay settling crypto industry customers via stablecoins

Rapyd enabling stablecoin-to-fiat conversion globally

Conduit building instant cross-border payment infrastructure

Implementation Guide: Moving Beyond the Trilemma

Phase 1: Pilot High-Volume, Low-Complexity Flows

Ideal Starting Use Cases:

Supplier payments in stable currency corridors (USD/EUR/GBP)

Recurring contractor and freelancer payments

Simple B2B transactions without complex terms

High-frequency, low-value international transfers

Implementation Steps:

Select stablecoin provider

with regulatory compliance and institutional custody

Integrate payment APIs

with existing accounting and ERP systems

Configure compliance workflows

for AML/KYC and sanctions screening

Test settlement processes

with small transaction volumes

Measure performance

against traditional payment rails

Success Metrics:

Settlement time reduction (target: 95%+ improvement)

Total cost savings (target: 80%+ fee reduction)

Process automation gains (target: 90%+ manual work elimination)

Error rate improvements (target: 99%+ accuracy)

Phase 2: Add Programmable Payment Features

Enhanced Capabilities:

Automated compliance checking and regulatory reporting

Conditional payment logic for trade finance and escrow

Dynamic payment terms based on business conditions

Multi-party settlement and revenue sharing

Technical Requirements:

Smart contract development or pre-built solution integration

Oracle connections for external data feeds

Multi-signature wallet setup for treasury controls

Real-time monitoring and alerting systems

Business Process Integration:

Invoice generation with programmable discount terms

Automatic payment splitting for marketplace transactions

Escrow release based on delivery confirmation

Subscription billing with yield-bearing account funding

Phase 3: Full Ecosystem Integration

Advanced Use Cases:

Treasury management with yield optimization during payment float

Cross-border payroll with automatic tax withholding

Supply chain finance with automated milestone payments

International marketplace settlement with instant vendor payouts

Infrastructure Considerations:

Multi-stablecoin strategy for geographic coverage

Integration with DeFi protocols for yield generation

Advanced smart contract logic for complex business rules

Comprehensive risk management and monitoring systems

Risk Management and Compliance

Operational Safeguards:

Multi-signature treasury controls with defined approval workflows

Automated compliance monitoring and exception handling

Real-time transaction tracking and audit trail maintenance

Disaster recovery and business continuity planning

Financial Controls:

Diversified stablecoin exposure across multiple regulated issuers

Regular reserve audits and third-party attestations

Clear redemption processes with guaranteed settlement

Integration with existing accounting standards and reporting

Regulatory Compliance:

KYC/AML procedures integrated with stablecoin workflows

Sanctions screening automated at transaction initiation

Regulatory reporting templates for cross-border payments

Jurisdiction-specific compliance rule implementation

The Future of Cross-Border Payments

Industry Transformation Timeline

2025-2026: Infrastructure Maturation

Major financial institutions launch stablecoin settlement services

Regulatory frameworks established in key jurisdictions

Integration with existing payment networks accelerates

Cost advantages drive adoption among price-sensitive segments

2027-2028: Feature Innovation

Programmable payment features become standard offerings

AI-powered compliance and risk management integration

Cross-chain interoperability enables seamless multi-network transactions

Small and medium businesses gain access to enterprise-grade payment infrastructure

2029-2030: Market Standardization

Stablecoins capture 20%+ of cross-border payment volume

Traditional correspondent banking relegated to specific use cases

Programmable payments enable new business models and services

Geographic payment corridors optimized for blockchain settlement

Competitive Advantage Windows

Early Adopter Benefits:

Cost leadership

through reduced transaction and operational expenses

Cash flow optimization

via instant settlement and yield-bearing accounts

Market expansion

into previously unprofitable international segments

Operational efficiency

through automated processes and reduced errors

Late Adopter Risks:

Competitive disadvantage in international market pricing

Higher operational costs compared to blockchain-native competitors

Limited ability to offer advanced payment features to customers

Dependence on increasingly expensive traditional payment infrastructure

Technology Roadmap

Immediate Capabilities (Available Now):

Basic stablecoin settlement for international payments

Simple smart contract automation for standard business logic

Integration with existing accounting and treasury management systems

Regulatory compliance tools for major jurisdictions

Emerging Features (2025-2026):

Advanced programmable payment logic with conditional execution

Cross-chain atomic swaps for multi-currency transactions

AI-powered fraud detection and compliance automation

Integration with central bank digital currencies (CBDCs)

Future Innovation (2027+):

Fully automated international business process execution

Decentralized identity and reputation systems for reduced KYC friction

AI-driven treasury optimization and risk management

Interoperable global payment infrastructure with instant settlement

Solving the Trilemma: Key Takeaways

The Math is Clear

Traditional cross-border payments force businesses to choose between speed, cost, and programmability. Stablecoins and programmable money infrastructure eliminate this trade-off entirely:

Speed: Settlement in minutes instead of days

Cost: Fees under 0.1% instead of 6%+

Programmability: Native automation instead of manual processes

Implementation Strategy

Start Simple:

Pilot with high-volume, straightforward international payments

Measure concrete improvements in speed, cost, and operational efficiency

Gradually add programmable features as confidence and expertise develop

Scale to full ecosystem integration with advanced treasury management

Plan for Scale:

Choose infrastructure partners with regulatory compliance and institutional focus

Design workflows that can handle growing transaction volumes

Build internal expertise in blockchain technology and smart contract development

Establish risk management procedures appropriate for digital asset operations

The Competitive Reality

The cross-border payments market is experiencing fundamental infrastructure transformation. Companies that adapt early will capture significant competitive advantages, while those that delay risk being disrupted by more agile competitors.The question isn't whether this transformation will happen—with the market projected to grow at 7.36% CAGR and stablecoins capturing increasing market share, the trend is clear.The question is whether your business will lead the transition or be forced to adapt to changes driven by more forward-thinking competitors.

Frequently Asked Questions

Q: How do stablecoins maintain price stability for cross-border payments?

A: Regulated stablecoins like USDC and USDT are backed by real-world assets (cash, treasury bills) held by audited institutions. This backing ensures 1:1 redemption value with the underlying currency, providing stability for business transactions.

Q: What regulatory considerations apply to stablecoin cross-border payments?

A: Businesses must comply with existing AML/KYC requirements, sanctions screening, and reporting obligations. Many stablecoin platforms provide built-in compliance tools, but consultation with legal experts is recommended for complex international operations.

Q: How do transaction costs compare between stablecoins and traditional methods?

A: Stablecoin transactions typically cost under $0.01 on efficient networks like Solana, compared to $25-$50+ for traditional wire transfers. Including FX spreads and intermediary fees, total savings often exceed 95% for international payments.

Q: Can small businesses access programmable cross-border payments?

A: Yes, many platforms now offer API-based programmable payment services designed for small and medium businesses. These solutions provide enterprise-grade features without requiring significant technical development resources.

Q: What happens if a stablecoin "depegs" from its underlying currency?

A: Well-regulated stablecoins from established issuers maintain tight pegs through robust backing and redemption mechanisms. For business payments, using multiple stablecoin providers and maintaining minimal balances reduces exposure to any single issuer.

Ready to eliminate the traditional trade-offs between speed, cost, and programmability in your cross-border payments? Discover how RebelFi's instant-yield infrastructure enables businesses to optimize all three simultaneously while earning passive income on payment float.