Every time you move money in crypto, there's a hidden cost you're paying, and it's not fees.

Picture this: You're managing a crypto treasury with $500K in USDC. You want to earn yield on business funds, so you deposit it into a DeFi lending protocol earning 8% APY. Great, your stablecoin business account is finally working for you.

But then reality hits. A client needs to be paid. A supplier invoice comes due. You need liquidity from your high yield business bank account crypto setup.

So you withdraw from the yield protocol, losing a day of earnings. Make your payment. Then re-deposit what's left, missing another day of yield while the transaction settles.

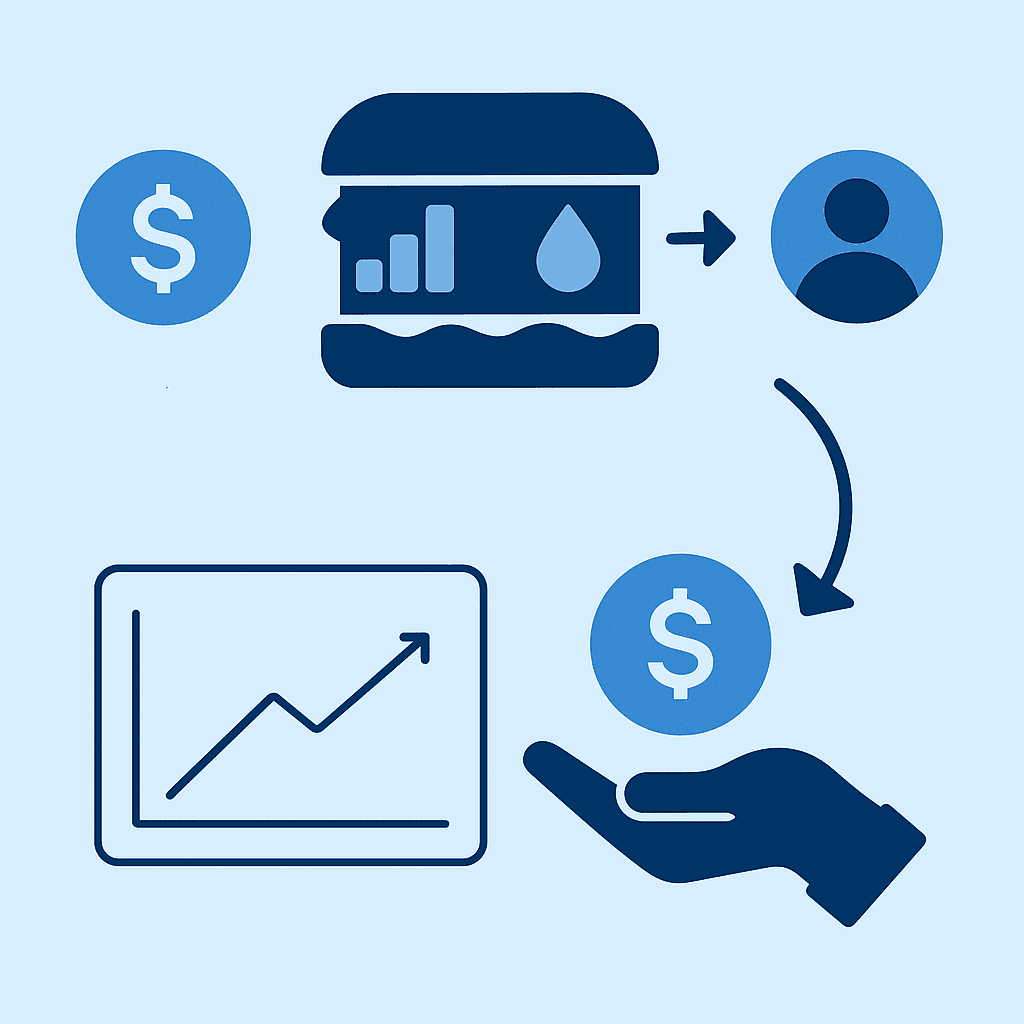

This is the stablecoin sandwich and it's why traditional crypto treasury management is broken.

The Hidden Inefficiency in DeFi Business Banking

The stablecoin sandwich happens every time your money gets caught between two states: earning yield and being liquid enough to spend. Traditional high yield business bank accounts force this trade-off. Even advanced DeFi business banking solutions make you choose between yield and liquidity.

Here's what most businesses don't realize: Every hour your stablecoins sit idle, whether in a wallet, during a transfer, or between transactions, you're losing potential earnings from your stablecoin business account.

With USDC currently yielding around 5-8% APY across various DeFi protocols, that $500K sitting idle for just 24 hours costs you approximately $68 in lost yield. For businesses using crypto treasury management, this "dead time" can add up to thousands in foregone earnings annually.

The Three Types of Dead Time That Kill Your Programmable Yield

1. Transfer Dead Time Your money stops earning yield the moment you withdraw it from a DeFi protocol, even if the actual payment won't happen for hours or days. Traditional stablecoin business accounts can't solve this.

2. Settlement Dead Time Most crypto payment processors and high yield business bank account solutions require funds to settle before they can be redeployed into yield-generating positions.

3. Operational Dead Time The time between receiving a payment and manually deploying it into a yield strategy, often overlooked but potentially the most expensive aspect of crypto treasury management.

Why Traditional DeFi Business Banking Solutions Fall Short

Most crypto payment platforms and DeFi business banking solutions treat yield and liquidity as separate features. You either have your money earning yield, or you have it ready to spend. Even advanced stablecoin business account providers that try to bridge this gap typically require:

Multiple transactions (withdraw → pay → re-deposit)

Manual crypto treasury management of when to move funds in and out of yield

Advance planning to withdraw funds before payments are needed

Complex treasury management to maintain the right balance of liquid vs. earning assets

Even the best high yield business bank account crypto solutions in traditional finance rarely exceed 1-2% APY, and they still require you to keep significant balances liquid for operations.

How Instant Yield DeFi Eliminates the Stablecoin Sandwich

RebelFi's programmable yield approach is fundamentally different: What if payments themselves could generate yield until the exact moment they're spent?

Our DeFi business banking platform uses what we call "instant yield infrastructure" every deposit, transfer, and payment flows through DeFi lending protocols in the same transaction. There's no gap between liquidity and yield because they happen atomically.

Programmable Yield: How Instant Yield DeFi Works

Payment Receipt: When your business receives a USDC payment, it doesn't just hit your stablecoin business account, it immediately gets deployed into a Drift Protocol lending vault in the same transaction.

Continuous Yield Accrual: Your payment starts earning yield from block one. No manual crypto treasury management, no waiting period.

Smart Withdrawals: When you need to make a payment, our programmable yield smart accounts withdraw the exact amount needed from the yield protocol as part of the payment transaction itself.

Automated Optimization: Your remaining balance continues earning yield without interruption, making this the most efficient high yield business bank account crypto solution available.

The result? Zero dead time. Zero manual management. Maximum capital efficiency for your DeFi business banking.

Real-World Capital Efficiency Gains with Programmable Yield

Let's run the numbers on how eliminating dead time impacts your crypto treasury management:

Case Study 1: E-commerce Business Using DeFi Business Banking

Average USDC Balance: $200,000

Monthly Payment Volume: $150,000 (payments to suppliers, contractors)

Traditional High Yield Business Bank Account: Keep $50K liquid (0% yield), $150K in DeFi (8% APY)

Actual Annual Yield: $12,000

With RebelFi's Instant Yield DeFi:

Full $200K earning 8% APY continuously

Annual Yield: $16,000

Efficiency Gain: $4,000 annually (33% increase)

Case Study 2: SaaS Platform's Stablecoin Business Account Strategy

Monthly Recurring Revenue: $100,000 USDC

Operating Expenses: $60,000/month

Traditional Crypto Treasury Management:

Collect revenue in business account (0% yield)

Move to DeFi monthly after expenses

Average dead time: 15 days per month

Capital Efficiency Loss: 15 days × $100K × 8% APY ÷ 365 = $329/month = $3,948 annually

With Programmable Yield: $0 lost yield + automated expense payments with continued yield on remaining balances.

Case Study 3: Crypto-Native Consulting Firm's DeFi Business Banking

Quarterly Revenue: $75,000 USDC

Monthly Burn Rate: $20,000

Payment Pattern: Irregular client payments, regular supplier payments

Traditional crypto treasury management requires constantly moving funds in and out of yield protocols based on cash flow forecasts. Even conservative estimates show 20-30 days of dead time annually.

Dead Time Cost: 25 days × $55K average × 8% APY ÷ 365 = $302 annually

Instant Yield DeFi Advantage: Elimination of all dead time + earned yield on payment float.

Why Programmable Yield Beats Traditional High Yield Business Bank Accounts

The real power of eliminating dead time isn't just in the immediate yield gains—it's in the compounding effect over time that no traditional high yield business bank account crypto solution can match.

Consider a growing business that scales from $100K to $500K in stablecoin volume over two years:

Traditional DeFi Business Banking Approach:

Year 1: $8,000 yield (with 25% dead time)

Year 2: $30,000 yield (with 25% dead time)

Total: $38,000

RebelFi's Instant Yield DeFi:

Year 1: $10,667 yield (zero dead time)

Year 2: $40,000 yield (zero dead time)

Total: $50,667

The difference: $12,667 in additional yield—equivalent to hiring another part-time contractor or investing in growth initiatives.

Beyond Yield: Operational Efficiency in Crypto Treasury Management

Eliminating the stablecoin sandwich doesn't just improve your returns—it simplifies your entire crypto treasury management process:

Reduced Complexity: No more manual optimization of liquid vs. earning balances in your stablecoin business account Better Cash Flow Forecasting: Every dollar works equally hard regardless of when it needs to be spent Automated Operations: Payments, programmable yield, and liquidity management happen automatically Real-Time Financial Health: Your yield earnings and operational cash flow are visible in real-time

The Technical Innovation Behind Instant Yield DeFi

RebelFi's programmable yield infrastructure is built on Solana's high-performance blockchain, enabling atomic transactions that would be prohibitively expensive on other networks. Our DeFi business banking smart account architecture handles the complex orchestration of:

Instant DeFi deployment of incoming funds to your stablecoin business account

Yield-aware payment processing that optimizes withdrawal timing

Continuous rebalancing to maintain optimal earning positions

Pull-based payments that keep your funds earning until the exact moment they're collected

This isn't just a UX improvement over traditional high yield business bank account solutions, it's a fundamental reimagining of how programmable money should work in crypto treasury management.

The Future of DeFi Business Banking and Programmable Yield

The stablecoin sandwich problem exists because most crypto treasury management tools are built like traditional finance: yield and liquidity are separate concerns that users must manually balance.

But programmable yield enables a better approach for DeFi business banking. When payments, yield, and liquidity are orchestrated by smart contracts rather than manual processes, capital efficiency becomes automatic rather than aspirational.

For businesses ready to eliminate dead time from their crypto treasury management, RebelFi offers a simple proposition: Keep earning yield on every dollar in your stablecoin business account, right up until the moment you spend it.

Your money should never have to choose between being productive and being useful. With instant yield DeFi infrastructure, it can be both.

Get Started with Programmable Yield Today

Traditional high yield business bank account crypto solutions force you to choose between yield and liquidity. RebelFi's DeFi business banking platform eliminates this trade-off entirely.

Ready to eliminate dead time from your crypto treasury management? Learn how RebelFi's instant yield DeFi infrastructure can optimize your stablecoin business account operations and deliver programmable yield that never sleeps.