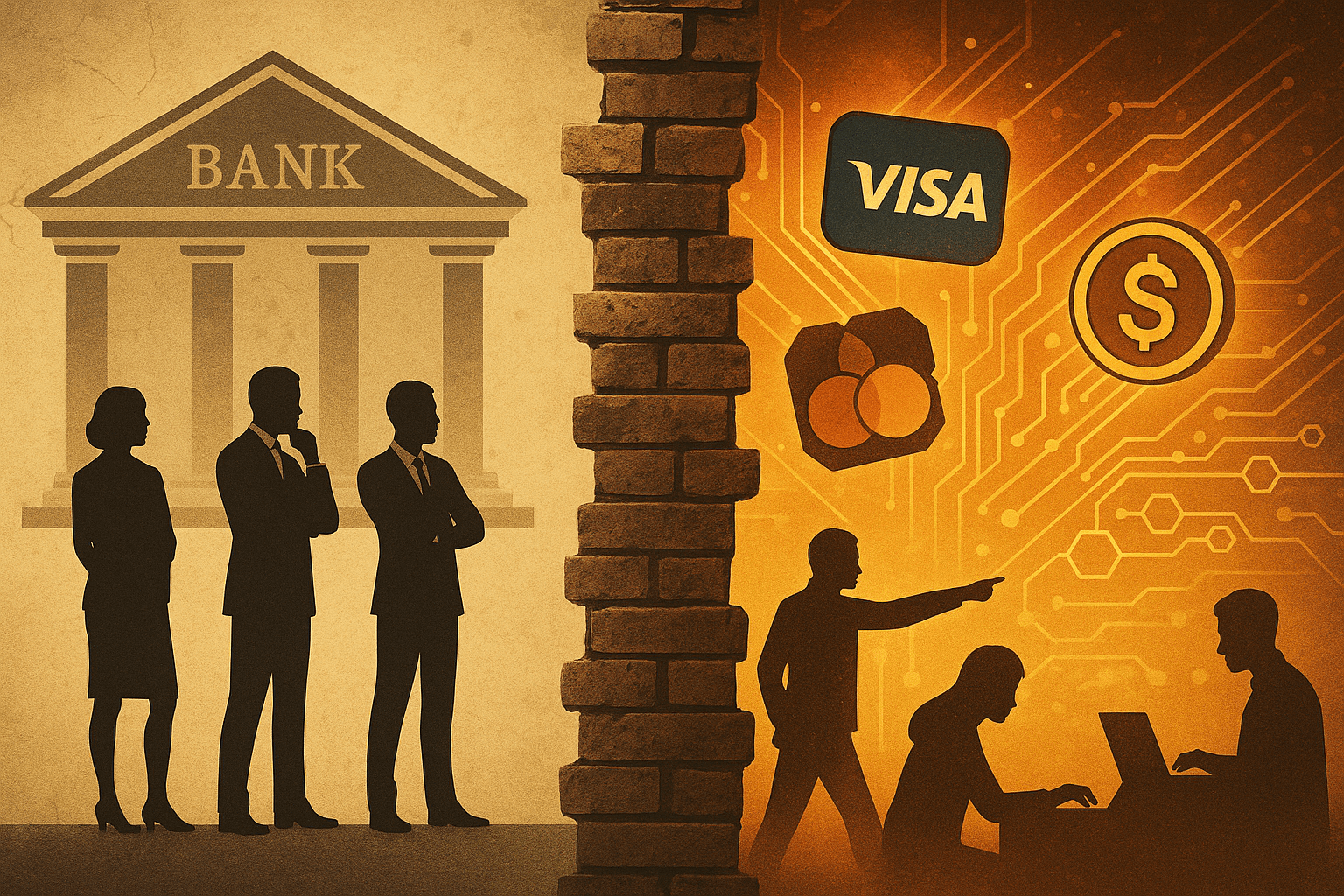

The financial services landscape is experiencing its most significant transformation since the advent of online banking. While traditional banks debate whether to embrace cryptocurrency and stablecoin infrastructure, forward-thinking institutions are already making moves, and payment giants like Visa and Mastercard are launching their own stablecoin initiatives. The question isn't whether crypto infrastructure will reshape banking, it's which banks will lead the transformation and which will be left behind.

The Writing on the Wall: Major Players Are Moving Fast

The signals couldn't be clearer. Bank of America, once skeptical of cryptocurrency, is now exploring stablecoin integration. Visa and Mastercard aren't just dipping their toes—they're diving headfirst into stablecoin infrastructure. These aren't speculative bets; they're strategic imperatives driven by fundamental shifts in how money moves in the digital economy.

The $220 billion stablecoin market isn't a sideshow—it's the preview of tomorrow's financial infrastructure. When payment networks that process trillions of dollars annually decide to build on this foundation, it signals a tectonic shift that no bank can afford to ignore.

The Stablecoin Rails Revolution: Redefining Global Finance

While banks debate crypto adoption, stablecoin payment rails are already processing billions in transactions with speeds and costs that make traditional banking infrastructure look antiquated. The $220+ billion stablecoin market isn't just about digital assets—it's about fundamentally superior financial infrastructure.

Cross-Border Payments: The $150 Trillion Opportunity

Traditional international wire transfers are a relic of the 20th century:

3-5 business days

for settlement

3-7% fees

for international transfers

Limited transparency

during processing

Restricted operating hours

(business days only)

Complex correspondent banking

relationships

Compare this to stablecoin rails:

Seconds to minutes

for global settlement

Under 0.1%

transaction costs

Full transparency

with blockchain verification

24/7/365

availability

Direct peer-to-peer

transfers

The banks that build on stablecoin infrastructure today will capture disproportionate market share in the $150 trillion annual cross-border payment market. Those clinging to SWIFT and correspondent banking will watch customers migrate to faster, cheaper alternatives.

The Embedded DeFi Advantage: Beyond Traditional Banking

But stablecoin rails are just the foundation. The real transformation comes from embedded DeFi infrastructure that turns every transaction into a revenue generating opportunity.

Consider the fundamental difference:

Traditional Banking Model:

Cross-border payments as a fee-collection service

Static interest rates on deposits (0.1-2%)

Revenue through spreads and transaction fees

Manual, time-consuming international transfers

Correspondent banking dependency

Embedded DeFi Banking Model:

Cross-border payments as instant, low-cost infrastructure

Dynamic yield optimization (6-8% returns)

Revenue through automated yield sharing

Programmable, instant global transactions

Direct blockchain settlement

The banks that understand this distinction first will capture disproportionate market share. Those that don't will find themselves competing on increasingly thin margins while their more innovative competitors offer superior returns and global reach.

The Network Effect Advantage: Why Early Movers Win Big

In financial infrastructure, network effects create winner-take-all dynamics. The banks that build comprehensive crypto banking solutions first don't just gain customers, they gain ecosystem advantages that become nearly impossible to replicate.

Consider the compounding benefits:

Capital Efficiency:

More deposits in DeFi protocols mean better yield optimization across the entire network

Customer Lock-in:

Businesses using embedded DeFi for treasury management, automated payouts, and yield generation create high switching costs

Data Advantages:

Understanding crypto-native customer behavior provides insights unavailable to traditional-only banks

Partnership Opportunities:

Early relationships with DeFi protocols, wallet providers, and crypto-native businesses

Real-World Implementation: The RebelFi Model

While banks debate strategy, platforms like RebelFi are already proving the model works. Our embedded DeFi infrastructure demonstrates how traditional banking concepts can be supercharged through blockchain technology:

High-Yield, Non-Custodial Accounts: Business funds automatically optimize across multiple DeFi protocols, delivering 6-8% yields while maintaining full transparency and control.

Programmable Finance Features:

Dynamic Discounting:

Invoices that adjust terms based on real-time yield calculations

Pull-Based Payouts:

Recipients can claim funds when needed, maximizing yield until the last second

Automated Treasury Management:

Smart accounts that automatically optimize cash positions

Zero-Fee Revenue Model: Instead of charging transaction fees, revenue comes from sharing the DeFi yields generated by customer deposits, creating alignment between bank profitability and customer returns.

This isn't theoretical. It's working today, generating superior returns for businesses while creating sustainable revenue streams that traditional fee models can't match.

The Risk of Inaction: Death by a Thousand Cuts

Banks that delay crypto infrastructure adoption face a gradual but devastating erosion of their business model:

Customer Migration: Tech-savvy businesses and high-net-worth individuals are already moving to crypto-enabled financial services for better yields, instant global transfers, and more sophisticated treasury management.

Cross-Border Disruption: Fintechs offering stablecoin-based international transfers are capturing market share from traditional wire services, processing billions in volume with superior speed and cost structure.

Margin Compression: Traditional banks will be forced to compete on increasingly thin spreads while crypto-enabled competitors generate revenue from yield optimization and capture the lucrative cross-border payments market.

Global Reach Limitations: Banks dependent on correspondent banking networks can't compete with the 24/7, instant settlement capabilities of stablecoin infrastructure.

Regulatory Lag: Banks that wait for "perfect" regulatory clarity will find themselves years behind competitors who learned to navigate the evolving landscape.

Talent Drain: The best financial technology talent is moving to crypto-enabled institutions, leaving traditional banks with legacy thinking and outdated capabilities.

The Bottom Line: Adapt or Become Irrelevant

The financial institutions thriving a decade from now will be those that recognized stablecoin infrastructure as the foundation of next-generation global banking, not a speculative distraction. They'll offer customers:

Superior Returns:

6-8% yields instead of 0.1% savings rates

Global Speed:

Instant international transfers instead of 3-5 day delays

Lower Costs:

Sub-1% cross-border fees instead of 3-7% wire transfer charges

Better Service:

24/7 global banking instead of business-hour limitations

Future-Proof Platform:

Stablecoin-native infrastructure ready for the next wave of digital finance innovation

The great banking divide is happening now. On one side: institutions clinging to legacy infrastructure, competing on shrinking margins, and watching customers migrate to better alternatives. On the other: banks embracing embedded DeFi infrastructure, generating superior returns, and building the financial platforms of the future.

The choice is simple, but the window is closing. The banks that act decisively today will dominate tomorrow's financial landscape. Those that wait will spend the next decade playing catch-up, if they survive at all.