The stablecoin market just hit an inflection point that will reshape digital finance forever. While everyone focuses on compliance, the smartest money is positioning for the forced unbundling that's about to create entirely new categories of winners.

The U.S. Senate passed the GENIUS Act on June 17, 2025, by a vote of 68-30, creating the first comprehensive federal framework for stablecoins. House Republicans are rushing to get this landmark stablecoin legislation to President Trump's desk as soon as July 7, 2025.

But buried in the regulatory language is a seismic market restructuring that most people are completely missing.

This isn't just about stablecoin regulation, it's about forced financial unbundling on a scale we haven't seen since Glass-Steagall.

What the GENIUS Act Actually Does: The Hidden Market Restructuring

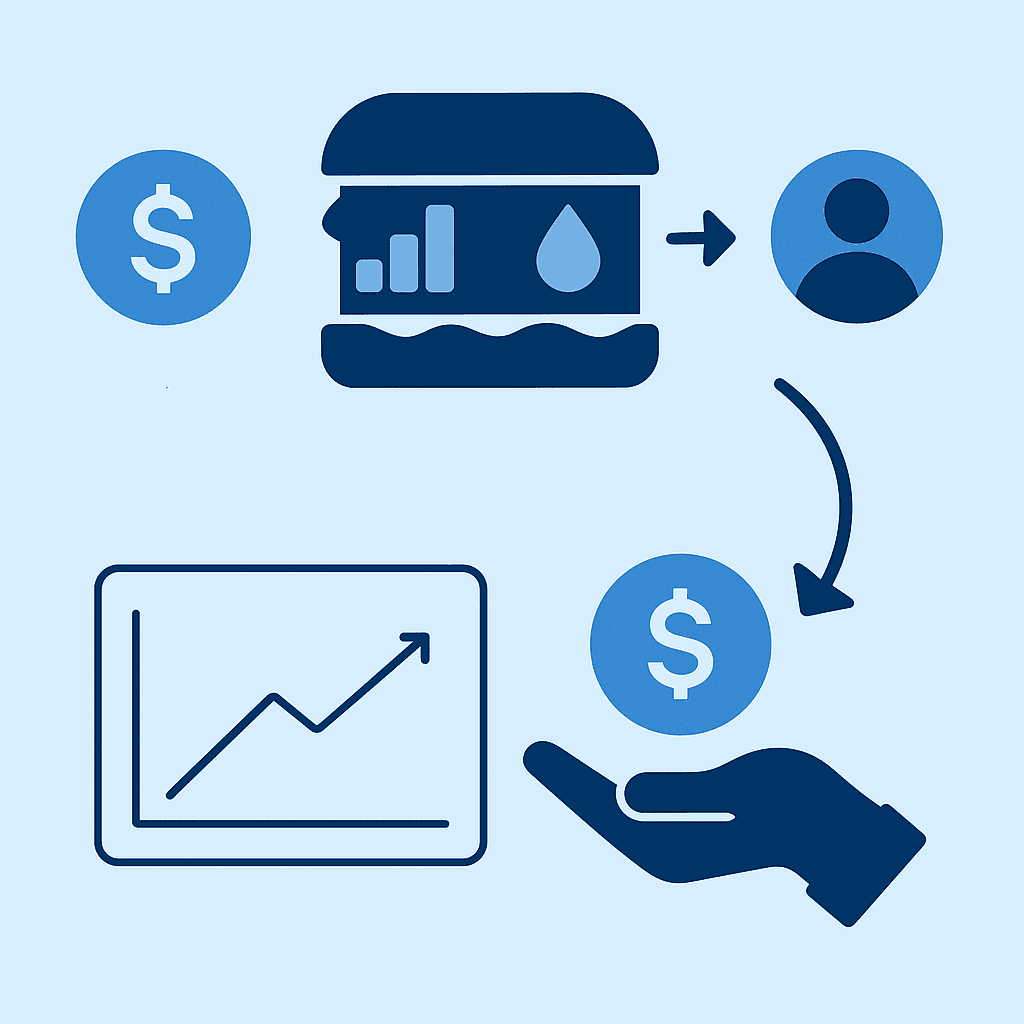

The GENIUS Act doesn't just regulate stablecoins; it systematically separates issuance, custody, and yield generation into distinct, regulated activities. For the first time in crypto, we're seeing regulatory-driven specialization that will create entirely new industries.

Here's what everyone's missing: The GENIUS Act restricts stablecoin issuers to only four specific activities:

Issue and redeem payment stablecoins

Manage reserves related to payment stablecoins

Provide custodial services for payment stablecoins

Support functions directly related to issuance and redemption

The kicker: Both the GENIUS and STABLE Acts prohibit yield-bearing consumer stablecoins. This seemingly simple restriction triggers a massive market restructuring.

The Forced Separation Creates Three Distinct Markets

Issuance Layer: Banks, fintechs, and retailers can issue compliant stablecoins but cannot offer yield directly to consumers.

Custody Layer: Separate entities must provide segregated custody services under strict federal banking regulations.

Yield Layer: Entirely new infrastructure must emerge to provide programmable yield on top of compliant stablecoins.

This regulatory architecture mirrors what happened when Glass-Steagall separated commercial and investment banking, except it's happening in fast-forward, creating immediate opportunities for specialized providers.

The $2 Trillion Market That's About to Explode

Treasury Secretary Scott Bessent told Congress that the U.S. stablecoin market could grow nearly eightfold to over $2 trillion in the next few years. But the real opportunity isn't just in growth, it's in value redistribution.

Current stablecoin transaction volume already hit $27.6 trillion in 2024, surpassing Visa and Mastercard combined. Under the old model, integrated platforms like Tether captured the entire value chain. Circle and Tether now hold more U.S. Treasury bills than major nations like Germany.

The GENIUS Act fractures this monopoly.

Why Integrated Platforms Will Struggle in the New Era

The conventional wisdom says integrated platforms have scale advantages. But regulation changes everything:

1. Compliance Overhead Favors Specialists Payment stablecoin issuers with over $50 billion must obtain annual audits and extensive regulatory reporting. Companies trying to do everything face scrutiny across multiple dimensions.

2. Innovation Restrictions The GENIUS Act recognizes that "payments products are different than banking products" and bans yield offerings. This forces innovation to happen outside the regulated layer.

3. Competitive Dynamics Shift The act restricts large tech companies from directly issuing stablecoins unless they partner with regulated entities. Even Amazon and Walmart must work with specialists.

The Three New Categories of Winners

Category 1: Corporate Stablecoin Issuers - The Distribution War

The Opportunity: Amazon and Walmart are reportedly moving toward stablecoin offerings. JPMorgan launched JPMD, a deposit token for institutional clients. Banks want to issue stablecoins to modernize treasury workflows.

The Winner Profile: Companies with existing customer relationships, regulatory infrastructure, and distribution networks.

Key Players to Watch: Major retailers (scale + customers), traditional banks (compliance + infrastructure), crypto-native companies (technical expertise).

Category 2: Specialized Custody Providers - The Infrastructure Play

The Opportunity: Custodians must comply with segregation requirements under federal banking law without additional capital requirements (reversing SAB 121). This creates massive demand for independent, auditable custody.

The Winner Profile: Entities with existing custody infrastructure and those offering crypto-native solutions at institutional scale.

Why This Matters: Unlike the bundled model, regulation now requires independent custody. This isn't just compliance, it's a new business category.

Category 3: Programmable Yield Infrastructure - The Biggest Prize

The Opportunity: Banks can issue stablecoins and provide custody, but cannot offer yield. This creates a massive market gap for yield infrastructure providers.

This is where RebelFi wins.

Why Yield Infrastructure Becomes the Most Valuable Layer

Here's the insight everyone's missing: Yield generation is now completely separated from stablecoin issuance, creating an entirely new market category.

Companies building programmable yield infrastructure can now:

Layer yield on top of any compliant stablecoin without touching issuance

Create programmable escrows that earn returns until funds are claimed

Build automated treasury management across multiple stablecoin providers

Develop pull-based payment systems that generate yield until settlement

This isn't just a workaround, it's a fundamentally superior model. Instead of hoping issuers share yield, businesses can directly capture the time-value of money through smart contracts.

The RebelFi Advantage: First-Mover in Programmable Yield

RebelFi's "Secure Transfer" primitive exemplifies this opportunity:

One transaction creates complete financial workflow

Instant yield the moment funds arrive in escrow

Programmable parameters for complex business logic

Multi-stablecoin support across all compliant issuers

While others focus on compliance, RebelFi is building the yield layer that every stablecoin issuer will need.

The Network Effects That Create Defensible Moats

Every good opportunity raises the question: What prevents commoditization?

For yield providers in the post-GENIUS world, the answer is network effects and composability:

1. Integration Depth The deeper the integration with business workflows, the higher the switching costs. RebelFi's pull-based payments and automated treasury features create operational dependencies.

2. Multi-Token Network Effects Supporting yield optimization across multiple stablecoin issuers creates ecosystem-wide value that individual issuers cannot replicate.

3. Programmable Composability Simple yield is commoditized. Programmable financial primitives—escrows, conditional payments, automated workflows are defensible.

4. Two-Sided Platform Dynamics Platforms serving both businesses and consumers create natural network effects that compound over time.

The Corporate Stablecoin Wave: The Ultimate Validation

Amazon and Walmart's rumored stablecoin plans aren't just adoption signals, they're validation of the entire unbundled model.

Corporate stablecoins will need:

Compliant issuance (regulatory requirement)

Independent custody (regulatory requirement)

Yield infrastructure (business necessity)

This creates perfect conditions for specialized providers. Corporate issuers will focus on compliance and distribution. They'll outsource yield infrastructure to specialists like RebelFi.

Timeline: The Next 18 Months Will Determine Everything

Q3 2025: GENIUS Act Signed House Republicans target July 7 for Trump's signature. The regulatory framework becomes law.

Q3-Q4 2025: Corporate Stablecoin Rush Major retailers and tech companies launch compliant stablecoins. First movers establish distribution advantages.

H2 2025: Banking Infrastructure Partnerships Traditional banks partner with specialized yield providers rather than building in-house capabilities.

2026: DeFi Integration Standards The winning yield providers establish themselves as the de facto standard for programmable stablecoin infrastructure.

What This Means for Different Business Types

For Crypto Companies

Threat: Existing integrated platforms lose yield advantages

Opportunity: Specialized infrastructure can compete on merit, not regulatory capture

For Traditional Finance

Threat: New competitors with programmable advantages

Opportunity: Partner with yield specialists to offer cutting-edge treasury services

For Enterprise

Threat: Rising compliance costs and customer expectations

Opportunity: Access to programmable financial tools that create competitive advantages

SEO-Optimized Takeaways: Key Search Terms and Trends

The GENIUS Act represents the most significant stablecoin regulation development since crypto's inception. As crypto treasury management becomes mainstream and stablecoin yield infrastructure matures, businesses need to understand:

Payment stablecoin compliance requirements under federal law

DeFi yield optimization strategies for business treasury

Programmable stablecoin infrastructure for automated financial workflows

Crypto payment processing solutions that generate revenue instead of costs

These stablecoin market trends will define business DeFi adoption through 2026 and beyond.

The Bottom Line: Specialization Beats Integration in Regulated Markets

The GENIUS Act isn't creating regulatory clarity, it's engineering a market restructuring that will define the next decade of digital finance.

The forced separation of issuance, custody, and yield creates three distinct value pools. Integrated platforms that dominated the unregulated era will struggle with compliance overhead and innovation restrictions. Specialized providers that excel in one layer will capture disproportionate value.

For companies building programmable yield infrastructure, this isn't just an opportunity, it's a category-defining moment. The stablecoin market will unbundle. The question is who captures the highest-value pieces.

The great stablecoin unbundling has begun. The winners will be those who understand that in regulated markets, specialization beats integration every time.

Ready to capitalize on the stablecoin unbundling opportunity? Learn how RebelFi's programmable yield infrastructure positions your business for the post-GENIUS Act world. The regulatory window is open, but it won't stay that way forever.